GoMyFinance: Your Guide To Debt, Budgeting & Investing

Are you tired of financial stress keeping you up at night? Mastering your finances doesn't have to be a daunting task; with the right tools and insights, you can take control of your financial future.

The world of personal finance can often feel like a labyrinth, filled with complex terms, confusing strategies, and the constant pressure of bills and unexpected expenses. It's easy to feel lost, especially when juggling multiple accounts, managing debt, and trying to save for the future. Thankfully, platforms like gomyfinance.com are emerging to simplify the process, offering a comprehensive suite of tools and resources designed to empower individuals to make informed financial decisions. Their approach emphasizes clarity, accessibility, and actionable strategies, all aimed at helping you navigate the complexities of personal finance with confidence.

At the heart of any successful financial plan lies a deep understanding of your current situation. Gomyfinance.com begins by taking a holistic approach to debt appraisal. The first step is always to know the scope of your debt, a crucial initial assessment. This involves a detailed examination of your financial condition, including a precise accounting of all outstanding debts, across all your accounts. Furthermore, they emphasize the importance of understanding the interest rates tied to your loans and credit cards, as this information is critical in devising effective repayment strategies and managing overall costs. This foundational step allows users to create a complete financial picture, so they can proceed in an informed way. This level of detailed analysis sets the stage for the development of a tailored financial strategy, taking into account your unique circumstances and goals.

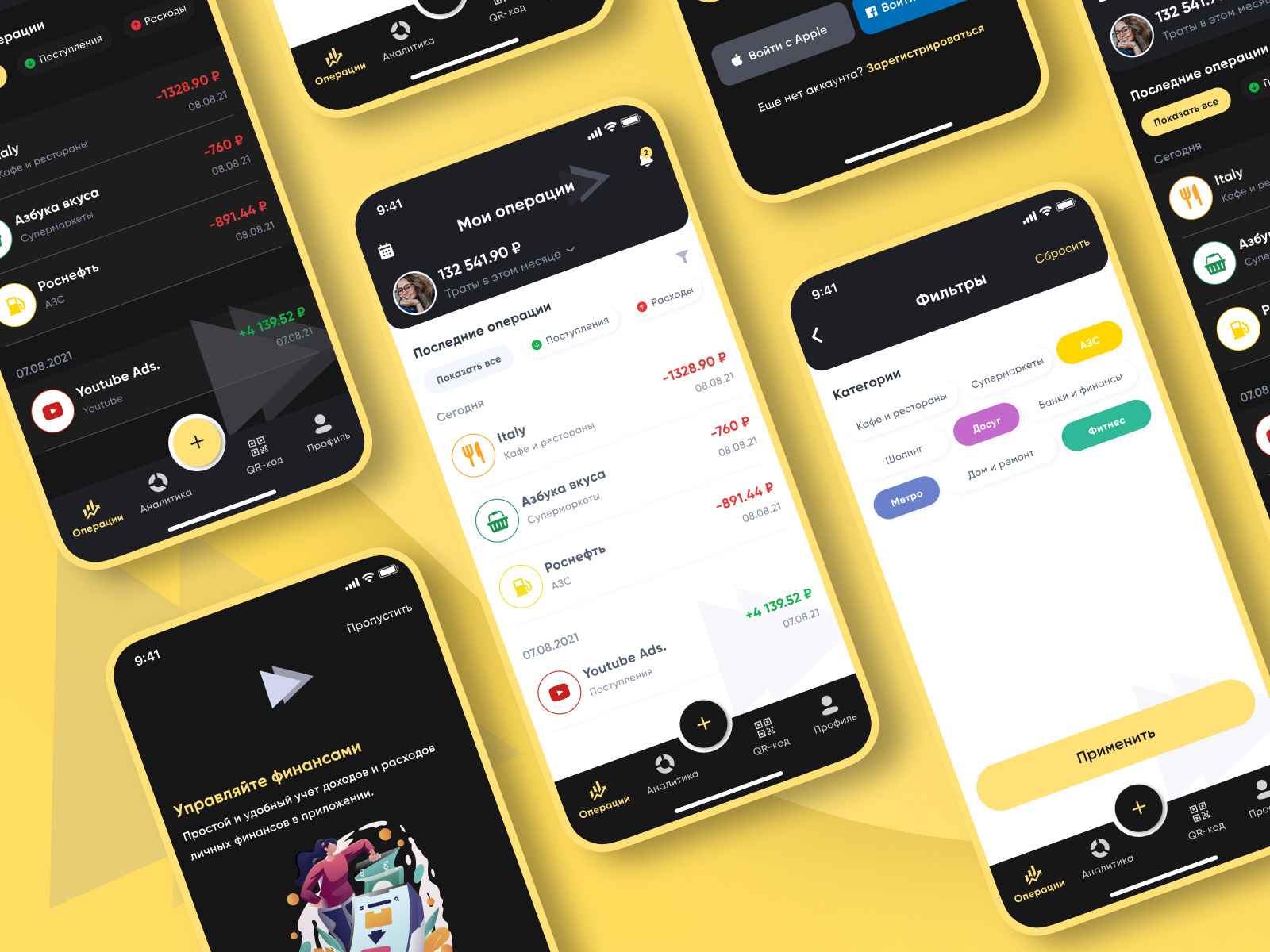

Beyond debt management, gomyfinance.com also provides users with tools to create budgets, manage their investments, and track their credit scores. Managing your budget is an empowering process that puts you in control of your money, helping you achieve your financial goals. A budget is a written plan for how you will spend and save your monthly income, allowing you to control your bills, reduce wasteful spending, and save for the future. This holistic approach simplifies finance, helps users save more and grow their wealth.

To illustrate the scope of services offered, consider the following table summarizing some of the core functionalities provided by gomyfinance.com:

| Feature | Description |

|---|---|

| Debt Appraisal | Comprehensive analysis of all debts, including total outstanding balances and interest rates. |

| Budgeting Tools | Tools to create and manage budgets, control spending, and track income. |

| Investment Management | Portfolio management tools, live analytics, and performance metrics to track investments. |

| Credit Score Services | Resources to track and improve credit scores. |

| Bill Management | Tools to organize bills and manage payments. |

| Saving Tools | Strategies and resources to help users save money. |

The platform's mission is clear: to empower everyone, regardless of their background or financial experience, to make informed financial decisions and achieve their goals. Understanding that finance can feel complex and intimidating, gomyfinance.com seeks to bridge the gap between finance and technology. They provide actionable blogs and expert insights, with the goal of simplifying personal finances and making them more accessible. Whether you want to stay on top of your bills, stick to a budget, or start investing, the platform promises tools to help you succeed.

Gomyfinance.com Invest provides an innovative platform that aims to simplify investing, making it accessible for both new and experienced investors. The platform offers intuitive tools, expert insights, and a streamlined approach to investing. It promises to help users make smarter investment choices. To further support this initiative, the platform provides access to live analytics and detailed performance metrics, which helps investors track their progress and gain insights into their investment journey.

Gomyfinance.com's commitment to its users extends beyond just providing tools; they are dedicated to enhancing financial literacy for individuals and small businesses. The platform offers practical resources and tools to improve financial health, and provides access to information about managing budgets and tracking credit scores. By utilizing these resources, users can explore comprehensive tools to save money, improve their credit scores, and create effective budgets for a brighter financial future. Whether you're a seasoned investor or just getting started, gomyfinance.com offers a wide range of features and services to help users navigate the complexities of the financial world. The platform also takes user security very seriously.

Gomyfinance.com also bridges the gap between finance and technology. They offer actionable blogs and expert insights to help users stay informed. Learning how to effectively utilize a "gomyfinance.com credit score" is an important part of financial planning, with the goal of achieving optimal outcomes.

For those looking to gain clarity in their financial lives, tracking expenses and creating a budget are essential first steps. By categorizing outgoing costs, users gain clarity on where their income is allocated and identify areas for potential cutbacks. Creating a clearly defined budget empowers individuals to take control of their finances. There is also guidance on the importance of setting financial goals to stay focused and motivated, utilizing tools to liquidate debt.

Moreover, the platform emphasizes the importance of security, assuring users that all transactions are protected by encryption standards. Credit card payments are PCI DSS 1 certified to prevent fraud and protect user information. Gomyfinance.com provides information regarding budgeting. Budgeting is a process that puts you in control of your money and helps you achieve your financial goals. By creating a written plan for how you will spend and save your monthly income, you can effectively control your bills, reduce wasteful spending, and save for the future.

Below is a table summarizing how gomyfinance.com aids users in achieving their financial goals. This table is crafted to provide a quick overview of the platforms features and their benefits.

| Goal | Gomyfinance.com Solution | Benefit |

|---|---|---|

| Debt Management | Debt appraisal, utilization of tools to liquidate debt. | Provides a comprehensive understanding of debt, facilitates strategic repayment plans. |

| Budgeting and Saving | Tools to create budgets, track expenses, and implement savings strategies. | Enables users to control spending, identify savings opportunities, and achieve financial goals. |

| Investment Growth | Investment tools, portfolio management, live analytics and performance metrics. | Simplifies investment process, provides data-driven insights, and helps users manage and grow their portfolios. |

| Financial Literacy | Actionable blogs, expert insights, comprehensive resources and tools. | Empowers users to make informed financial decisions and achieve their financial goals. |

| Credit Score Improvement | Credit score tracking and analysis, with tools to improve credit health. | Helps users understand their credit standing, and gives tools to improve their scores. |

For those seeking to streamline their finances, gomyfinance.com provides a comprehensive platform where users can manage their finances. The platform facilitates online payments, provides invoice information, and assists in resolving disputes. This comprehensive approach ensures that users have all the tools necessary to navigate the complexities of finance in one central location.

Whether it is understanding debt, managing a budget, discovering the best investment methods, tracking credit scores, or tackling debt, gomyfinance.com provides the tools and resources necessary for financial success. The platform's mission is to bridge the gap between finance and technology by offering actionable blogs and expert insights, and the platform understands the challenges users face. Gomyfinance.com provides support and assistance and helps users on their journey towards financial independence.